What Do Q-tips and Mutual Funds Have in Common?

I love reading labels on just about everything I buy. Maybe the habit started when I was a kid, looking for the toy that would come in my box of Cracker Jacks or Honey Combs. Now that I am over 40 years old and watch what I eat, I often read nutrition labels for my health. I also love reading the fine print to satisfy my curiosity.

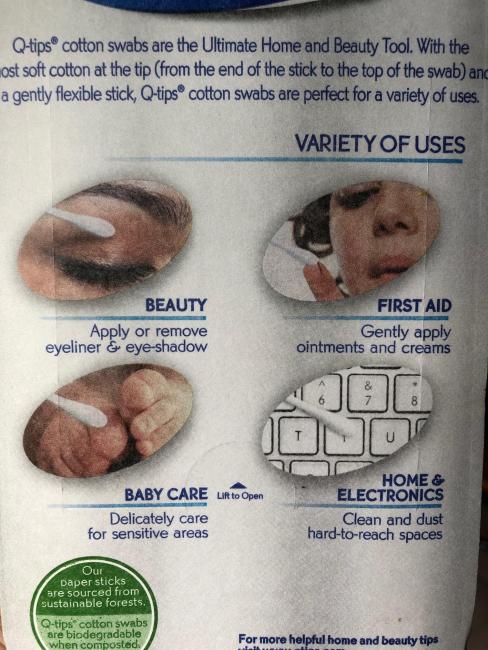

One day not long ago, I was brushing my teeth and decided to study the back of one of our bathroom staples, a box of Q-tips. I had to pass the time some way! The box helped inform me of all the wonderful uses of the product. I examined the images and description of potential applications. Let’s see...Of course I can remove make-up with them. Yes, I know, they are good for first aid. I can also dig dirt out of small cracks, everybody knows that!

But as I looked at the images, I noticed that one picture was noticeably absent. There was no mention of using these delightful swabs anywhere near the ear canal. I wondered, “Why did the Q-Tip executives omit its primary use?!?!” Something was just not right here...

I examined further and turned the box on the side to read the following:

“WARNING: Do not insert swab into ear canal. Entering the ear canal can cause injury. If used to clean ears, stroke swab gently around the outer surface of the ear only.”

I was bewildered. Crestfallen. Befuddled. Have I been using this product incorrectly for nearly 40 years? Have I been putting myself at risk? How could I have been so terribly mistaken for nearly four decades? Have I been causing damage to my ears and to my hearing? How did I not find this out sooner?

For years afterward, I continued with my old habits. I ignored the warning and continued to jab and swirl, jab and swirl. The comforting swab made my ear canal feel so good. Surely, I knew better than the over-cautious Q-Tip executives and did not need to concern myself with this warning.

Eventually, the guilt inside got the better of me. I felt the nagging feeling that I needed to do some research, so I went to Google and confirmed that the warning was actually there for good reason. There is significant evidence that inserting the swabs in your ears actually can cause problems. Now, our family Q-tip budget has shrunk significantly.

So what does any of this have to do with mutual funds or investing?

Pick up a fact sheet or prospectus for any mutual fund or ETF, and you will see the words written very clearly and in bold:

“Past performance is no guarantee of future results.”

This warning is much more conspicuous than the warning on the Q-tip package. It is so common that both novice and seasoned investors are familiar and can even recite it verbatim. Even so, it is often ignored by investors and advisors alike. Time after time, investors attempt to chase the “winners,” only to be disappointed later when the good performance does not hold up.

When you are picking investments in your 401(k), or deciding on the most appropriate investments with your advisor, how do you decide where to put your money?

Understandably, you may go straight to the performance and look for the investments that have the best returns over the last year, or the last few years.

The problem is: There’s actually significant data that shows that investments that have performed well at times do not hold up well going forward. The investments that have done well are also at times not the ones that will do well. Don’t believe me? Ask anyone who fell off the tech bandwagon in 2000. Ask the people who invested too heavily in banks in 2008 how they enjoyed the ride down. To dive deeper into one particular study about the persistence of fund performance from the National Bureau of Economic Research, read this white paper.

So this fact begs the questions: How do you determine which funds are best for you? If you cannot rely on past performance, what metrics can you turn to?

One area to consider might be index funds and similar low-cost strategies. There can be direct correlation between higher expense funds and under-performance. The more expensive the fund, the more likely it will underperform. Don’t believe me? Here is one of many articles that underscore this point.

Second, meet with an advisor to determine the level of risk appropriate for your age, income needs, and time horizon. You should pick a portfolio you can stick with through the ups and downs of the market. Instead of attempting to time the market, pick the right allocation and rebalance based on market conditions and your life circumstances.

Lastly, talk with your advisor about diversification to determine the weighting of the various funds in your portfolio. We believe in value investing, which has underperformed in recent years, but has been staging a comeback lately. Smaller companies may perform better over time and also carry additional risk. Determine how much you should allocate to each of these areas.

So what do Q-Tips and mutual funds have in common? With both, you should PAY ATTENTION TO THE WARNING LABELS!

Don’t believe you know better, or that the labels don’t apply to you. While it may be unlikely that you will go deaf by swirling the swab around your ear canal, you still should think twice about jabbing a stick within inches of your brain.

Similarly, picking funds with good performance may work out well over the short-term. But if you are going to make the best decisions, there are many other factors you should consider. Don’t take shortcuts with something as important as your family’s financial future.

When you educate yourself, meet with your advisor, and make conscious decisions based on research, you are more likely to have a better outcome and to reach your goals in retirement.

For more helpful content, please visit our blog page or video page on our website for similar articles or videos to help you plan. We also have created guides free for you to download, such as Five Tax Strategies Retirees Often Overlook and Six Mistakes Grandparents Often Make.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Investing in mutual funds involves risk, including possible loss of principal. Fund value will fluctuate with market conditions and it may not achieve its investment objective.